|

|

|

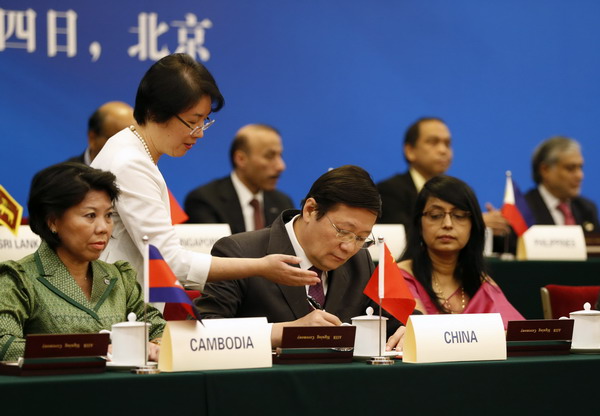

China's Finance Minister Lou Jiwei (C) signs a document, with the guests of the signing ceremony of the Asian Infrastructure Investment Bank at the Great Hall of the People in Beijing October 24, 2014. [Photo / Agencies] |

The Barack Obama administration is looking increasingly left behind as it defies its closest allies and the US president's own party on foreign economic policy in Asia. The Obama administration rebuked the United Kingdom for agreeing to participate in negotiations for the Asian Infrastructure Investment Bank, even though the new institution would fill a major gap in Asian infrastructure needs.

At the same time, Obama abandoned his own party in an attempt to ram through authority to finalize the Trans-Pacific Partnership agreement, a trade deal with Pacific Rim countries that would bring little economic benefit and high economic cost either to Asia or the United States.

In the wake of the global financial crisis of 2008-9, China offered its newly acquired financial prowess to help boost Western-led financial institutions such as the International Monetary Fund and the World Bank. Although the Obama administration backed reforms at these institutions that would have given China more say, it has done little to counter an intransigent US Congress that, under Republican leadership, has failed to pass those critical reforms.

Already stuffed with low-yielding US Treasuries in need of a higher return, China has decided to go its own way. That is why China is establishing the AIIB with an initial capital of $50 billion and a Silk Road Fund with $40 billion. Both are aimed at investing in infrastructure projects in Asia and beyond. In 2014, China also established the New Development Bank, along with Brazil, Russia, India and South Africa. This institution has an initial capital of $100 billion.

These moves, intended to diversify the global funding landscape, come on top of financing that China's own development banks already provide across the world. The China Development Bank has $100 billion in capital and more than $1 trillion in assets.

China's more intense global engagement — generally something not just welcomed, but demanded by the US government and politicians in Congress alike — does have some surprising consequences in the real world: The China Development Bank and the Export Import Bank of China now provide more loans to Latin American governments than the World Bank and the Inter-American Development Bank — and more loans to Asia than the World Bank and the Asian Development Bank.