|

|

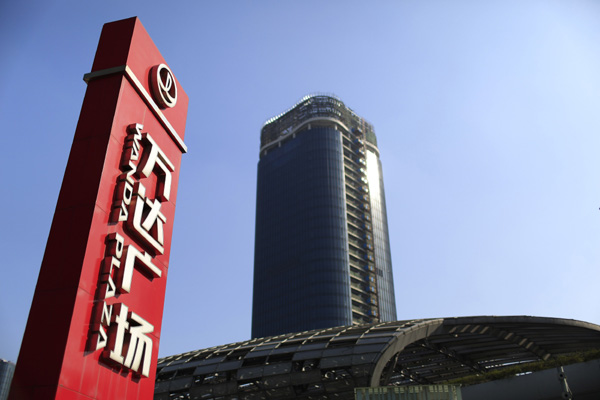

The logo of Wanda Plaza is seen in Shanghai December 23, 2014. [Photo/Agencies] |

Not far behind is one of Manchester United's Premier League rivals, Arsenal. Its new stadium, the Emirates, which opened at the start of the 2006-07 season is the main reason for the club's $384 million debt.

Real Madrid and Barcelona do not fare much better with current debt levels of $165 million and $156 million respectively.

The causes of these debts vary from the capital investment needed to build a totally new ground to the exorbitantly high wage bills at many of Europe's top clubs such as Barcelona. Real Madrid's habit of forking out the highest amounts in transfer deals almost certainly explains its current debt level.

But far lesser known soccer clubs also find themselves heavily and dangerously in debt, often due to relegation from the top tier of their domestic league. These clubs may benefit most from a Wanda-like investment injection.

Two of the most recent casualties of the England Premier League, Bolton Wanderers and Queens Park Rangers are perfect examples.

At the end of the of the 2012-13 English Premier League campaign, QPR found themselves relegated. As a result of their relegation from England's top flight, QPR's revenue stream shrunk. The club's current debt level stands at $145 million.

After an 11-year stay in the English Premier League, Bolton were relegated at the end of the 2011-12 season and suffered a QPR-style nosedive in revenue. At the end of 2013, the club announced that its debt had grown to $267 million and that they had lost more than $83 million in one year alone.

Such is the revenue gap between the top tier in most of European soccer's domestic leagues and the next level down that these devastating riches-to-rags stories look set to continue. Ideal investment opportunities for Wanda and other European-focused, cash-rich Chinese corporations.

Wanda's Athletico Madrid investment move could, therefore, be the first of many more by the company and other Chinese companies with similar European expansion plans.

European soccer clubs should welcome this possibility with open arms. Wanda and most other Chinese European-expanding companies will probably provide much-needed investment from their existing cash reserves and will not add to any financial burden with any debt-financed capital injection. Chinese business leaders, while more and more determined to expand into and across lucrative European markets, remain cautious and conservative when it comes to financing overseas market penetration. That is good news for Europe's already debt-ridden and cash-strapped soccer clubs.

Furthermore, a Chinese investor will surely allow a top European soccer club to appeal more to the soccer-mad Chinese public.

The European soccer industry and its top flight clubs should study closely the Wanda capital injection at Athletico Madrid and put Chinese companies and Chinese entrepreneurs firmly on their investor radar.

The author is a visiting professor at the University of International Business and Economics in Beijing and a senior lecturer in marketing at Southampton Solent University's School of Business. The views do not necessarily reflect those of China Daily.