|

| |

|

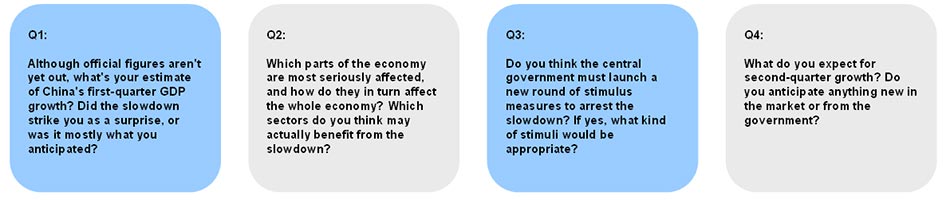

China's first-quarter economic growth probably slowed further from last year, and that deceleration will persist into the second quarter, according to many observers. But it's a bit of a surprise that few of them are surprised. And none argues that it's time for the government to launch a massive stimulus program. This can be interpreted as support for the stance adopted by Premier Li Keqiang, who told a high-level forum in Bo'ao, Hainan province last week that China won't print money to support higher growth. Some sectors may be more affected than others by the ongoing slowdown. Some industries may go through more painful readjustments than the rest of the economy. There are also other industries that may experience less difficulty or even faster growth. To identify these industries, China Daily solicited comments from economic experts who are familiar with the country. Most of them also tend to agree that the economy will show a slight increase in growth beginning with the third quarter.

| |

|

We expect GDP growth to slow down further and bottom at 7.1 percent in the second quarter.

----- Zhang Zhiwei

RESEARCH ANALYST WITH NOMURA SECURITIES CO LTD | |

|

Overcapacity is a perennial issue. The issue has become particularly severe in the past year, and I do not expect it to be resolved in the short term. However, I would stress that so far, these risks are controllable. The simultaneous emergence of so many issues isn't necessarily a completely bad thing ... The earlier they emerge, the better. Sectors such as energy conservation, environmental protection, urban utilities and healthcare will benefit from the urbanization drive. They are positive, despite the economic problems.

I do not think it is appropriate to further ease monetary policy to spur the economy, because the problem now is not a lack of money (actually, there is too much) but the lack of efficiency in the whole financial system. If you look at how ordinary depositors are frustrated by banks' low interest rates, while many small firms are starved for cash, you will understand how low the efficiency is. China has to accelerate its liberalization of the financial sector to improve the efficiency of credit allocation. Simply scaling up money supply will not help.

The implementation of promised reform agendas should be put into action rather just being talked about. If the government really changes, the market will give a quick, positive response.? -----?Gary Liu EXECUTIVE DEPUTY DIRECTOR OF THE CHINA EUROPE INTERNATIONAL BUSINESS SCHOOL LUJIAZUI INSTITUTE OF INTERNATION FINANCE | |

|

Despite the weak start to the year, we remain relatively constructive on China's economic growth outlook for this year. We continue to expect many of China's organic domestic growth drivers to remain in place, notably consumption, urbanization and services. Global demand growth is on a gradually improving trend, which will help China's economy this year.?

Other parts of the economy may have been holding up better than manufacturing. Swings in manufacturing growth tend to be more pronounced than those in the services sector. Also, in China, the role of the services sector is increasing because of a changing growth pattern. In 2013, the services sector grew faster than industry, with the difference particularly pronounced in nominal terms because pricing power has also been better in services. Therefore, the nonmanufacturing PMI held up better in recent months, and that's helped keep the labor market healthy.

As to the current outlook and the upshot for policy, we think Li basically confirmed that the government is going to take some measures to support growth. The policy measures he called for include accelerating the construction of key investment projects, in particular railways, highways and water projects in the central and western regions. Another facet is supporting the construction of affordable housing. This does not mean a major, or high-profile, stimulus plan, because these projects are already in China's medium-term plans. But the call to accelerate them does matter, nonetheless, in terms of what it means for the macroeconomic policy stance.

We also slightly lowered the figure for the second quarter, which also affected the full-year GDP growth projection. We now project GDP growth to have declined from 7.7 percent in the fourth quarter of 2013 to 7.5 percent in the first quarter this year, then to edge up to 7.6 percent in the second quarter. Our forecast is 7.7 percent for the year as a whole. How this growth will materialize in terms of organic growth and policy dynamics is more important than the numbers themselves, and the evolution of macroeconomic policy is key here. We think that it would not be necessary or recommended to pursue expansionary policies even if GDP growth threatens to falls to 6.5 to 7 percent, given healthy labor market trends. -----Louis Kuijs CHIEF ECONOMIST IN CHINA AT ROYAL BANK OF SCOTLAND PLC | |

|

We don't think there will be a big stimulus. Pro-growth policies, if any, will be very small and targeted, which will help to moderate the slowdown. Those policies aren't likely to turn the trend around.

We expect economic growth to stabilize at about 7.2 to 7.5 percent. Reforms such as interest rate liberalization and cleaning up banks' bad debt will be carried out in the foreseeable future. ? ----- Zhou Hao CHINA ECONOMIST WITH AUSTRALIA AND NEWZEALAND BANKING GROUP LTD | |

|

The 7.5 percent growth target for 2014 could be the ceiling instead of the bottom line.

This challenging period, however, will provide opportunities for emerging industries such as e-commerce and Internet finance. Fierce competition in the market will lead to more innovation in the market. Only innovative companies will survive.  Given the current level of economic growth, I don't think the government needs to launch a stimulus to boost the economy. Growth of 7 percent, or even 6.5 percent, should be tolerable to achieve economic restructuring for quality growth. Slower growth is a necessary cost to achieve more sustainable long-term growth. Moreover, the real effect of the traditional stimulus measures is weakening. It's questionable whether they can boost the economy like they did previously.

On the government side, I think local governments could cut some taxes, mainly on business income. They can also do more to reduce administrative charges. ----- Wang Haifeng DIRECTOR OF THE INSTITUDE FOR INTERNATIONAL ECONOMIC RESEARCH, WHICH IS UNDER THE NATIONAL DEVELOPMENT AND REFORM COMMISSION | |

|

One major factor dragging down growth is the changing momentum for economic development. China is in the process of shifting from the pure pursuit of GDP to rebalancing through systematic reforms. And such a shift is gradual and painful, because the ongoing anti-corruption campaign has in part contained and repressed investment. In general, local governments are giving cold shoulders to the current reforms.

the most affected. Steel, cement and real estate are among the most vulnerable sectors. Other relevant industries, such as home appliances and decoration, may also be hit hard. Consumption or service industries will have better shots against the lackluster economy. Internet, telecommunications and medical care are likely to be the leading countercyclical industries.

But we can still expect a stimulus that is significantly lower than the 4 trillion yuan injection in 2008. The core will be to enhance the effectiveness of investment. On the one hand, the government should carry out shantytown reconstruction. The tax burden of small and medium-sized enterprises should be further mitigated to reinvigorate manufacturing and protect labor rights. The second quarter is definitely critical to China's year-round economic performance. I would expect more substantial stimulus programs to be rolled out so that any continued slump can be effectively contained. Potential opportunities may lie in the relaxation of property-purchase restrictions in second-and third-tier cities in the hope that inelastic demands of homebuyers can be satisfied. ----- Shao Yu CHIEF ECONOMIST, ORIENT SECURITIES CO LTD |