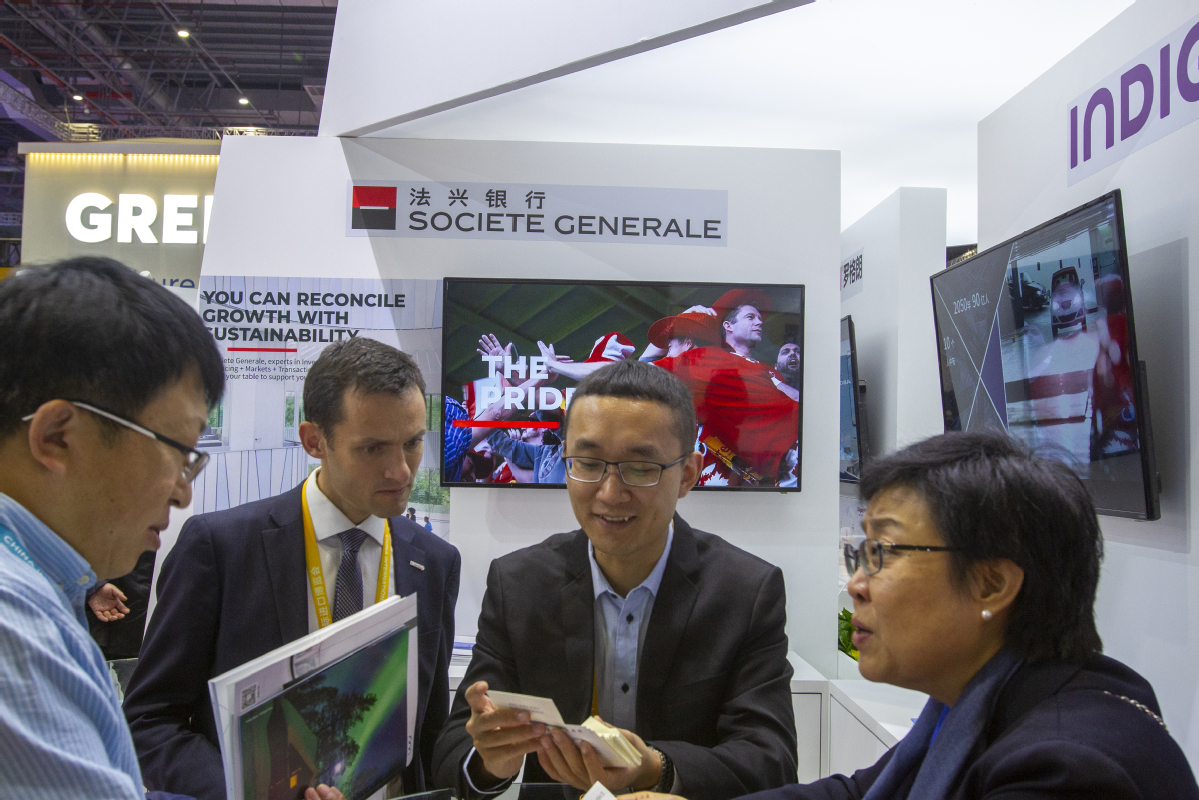

Opening-up key priority in ongoing financial reforms

Economists said the proportion of bonds held by foreign investors relies heavily on opening-up measures in the capital market.

"If capital can flow cross-border more freely, China's bond market will attract more foreign funds, as now the interest rate-premium between the renminbi and the US dollar has been expanded to a record high level," said Ming Ming, a senior analyst with CITIC Securities.

Promoting the internationalization of the yuan would be another key measure, which requires expanding the currency's usage in cross-border trade, investment and commodity transactions through currency swaps, foreign aid and external concession loans, said Zhang Xiaohui, former assistant to the central bank governor.

Zhang said facilitating the cross-border payment infrastructure to improve the efficiency of yuan clearing and settlement can also help Chinese companies grow in foreign markets. That is an important part of the "external circulation" of the dual circulation development model.

Recently, financial regulators and scholars refocused on the issue of opening the nation's capital account, as the world's second largest economy has quickly rebounded from the economic contraction in the first quarter, which was hit by COVID-19. The currency showed a strong momentum of appreciation against the US dollar, and the financial sector could use this "time window" to further integrate into the world's financial system.

"(Capital account opening) is an unavoidable choice for China, no matter what kind of difficulties we will encounter over the short term," said Huang Yiping, deputy dean of the National School of Development at Peking University, who is also a former member of the PBOC's monetary policy committee.

Huang said taking prudential macro-measures during the capital account opening process was originally proposed with the intention of penalizing short-term cross-border speculative investment. And the tax rate could be 0.1 percent to 0.2 percent, for both capital inflows and outflows, he added.

The measures can curb "hot money" flowing into the domestic financial market in search of higher returns before rushing back out, as these activities will lead to fluctuations and crashes.

The capital account opening process has been on the nation's economic reform schedule for a long time. The topic was recently readdressed as top-level policymakers highlighted the "dual circulation" economic development model since May-a strategy to maintain economic growth momentum mainly by relying on the domestic market. It could be a core policy direction for the country's development plan for the next five years, according to analysts.

"It doesn't mean we will give up external markets. Instead, we will improve the quality of opening-up measures, especially for the financial sector," said Li Yang, director of the National Institute for Finance and Development, a think tank.

Li added that a more open capital market, especially the bond market, will help facilitate the internationalization of the yuan, another key reform to support the "dual circulation" economic development plan in the coming years.